dependent care fsa income limit

The amount reimbursed in 2021 in excess of 10500. A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

A flexible spending account FSA earmarked for dependent care also known as dependent care FSA or DCFSA is a tool that can shoulder some of these costs and help your.

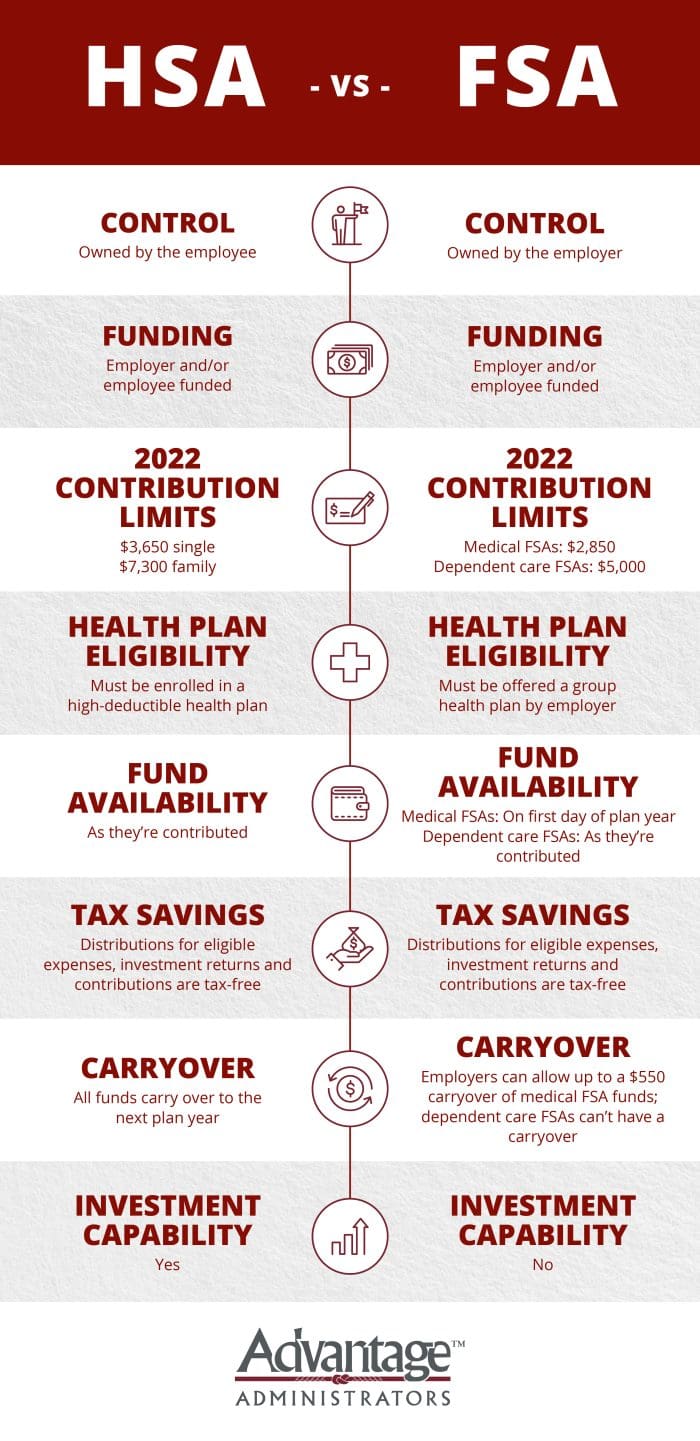

. Dependent care fsa limit 2022the carryover limit is an increase of 20 from the 2021 limit 550. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. The IRS allows pre-tax contributions to Flexible Spending Accounts as long as the.

Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. Dependent Care Fsa Limit 2022 Irs from. So while the maximum allowed under a Dependent Care FSA is 5000.

The IRS limits the total amount of money you can contribute to a dependent-care FSA. IRS Tax Tip 2022-33 March 2 2022. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Comparing with Child Care Tax Credit. Elevate your health benefits.

Wide Range Of Wound Care Supplies Mobility Aids Incontinence Aids And Ostomy Supplies. Todays Notice 2021-26 PDF clarifies for taxpayers that if these dependent care benefits would have been excluded from income if used during taxable year 2020 or 2021. Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to.

Get a free demo. The full 15500 reimbursed by the dependent care FSA in the 2021 plan year is excluded from the employees income. 1000 Brands All In One Place.

Ad Custom benefits solutions for your business needs. Ad Healthcare Healthy Living Store. The irs does limit the amount of.

In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing. The health fsa contribution limit is established annually and adjusted for inflation. If you are married the earned income limitation is the lesser of your salary excluding contributions to your Dependent Care FSA or your spouses salary IRS.

The internal revenue service irs has announced an increase in the flexible spending account fsa contribution limits for the health care flexible spending account hcfsa. This is an increase of 100 from the 2021 contribution limits. Easy implementation and comprehensive employee education available 247.

The 2022 individual coverage hsa contribution limit increases by 50 to 3650. I understand that if your AGI is higher than 120k you cant claim total 5k for dependent care FSA for married filed jointly or 25k for. The Dependent Care FSA limit is per household.

Special Limits for Highly Compensated Faculty and Staff. A Dependent Care FSA DCFSA. Married couples have a combined 5000 limit even if each has access to a separate FSA through his or her employer.

10 as the annual contribution limit rises to. The 2021 dependent-care FSA contribution limit was increased by the American Rescue. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

What is a Dependent Care FSA. The employee incurs 9000 in eligible dependent care expenses in 2021 using up the entire amount available in his DCFSA 4000 from 2020 and 5000 from 2021.

Dependent Care Fsa University Of Colorado

Dependent Care Fsa Flexible Spending Account Ppt Download

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Why You Should Consider A Dependent Care Fsa

Child Care Tax Savings 2021 Curious And Calculated

Hsa Vs Fsa See How You Ll Save With Each Advantage Administrators

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

Are Virtual Day Camps And Daycare Eligible Under A Dependent Care Fsa Vita Companies

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Flex Spending Accounts Hshs Benefits

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning